5

(2)

Navigating the digital marketplace requires a keen eye for detail, especially when selecting the ideal payment gateway for your Shopify store. An inadequately chosen payment provider can have detrimental consequences, potentially hindering the checkout process with its complexity, limiting available payment options, or, even more concerning, raising security vulnerabilities.

So, let’s roll up our sleeves and stroll through the world of payment options. We’re here to discuss the good, the bad, and the nitty-gritty of popular payment methods, helping you pick the one that’ll have your customers happily clicking ‘Complete Purchase‘. Ready to find your store’s perfect payment match? Let’s dive in!

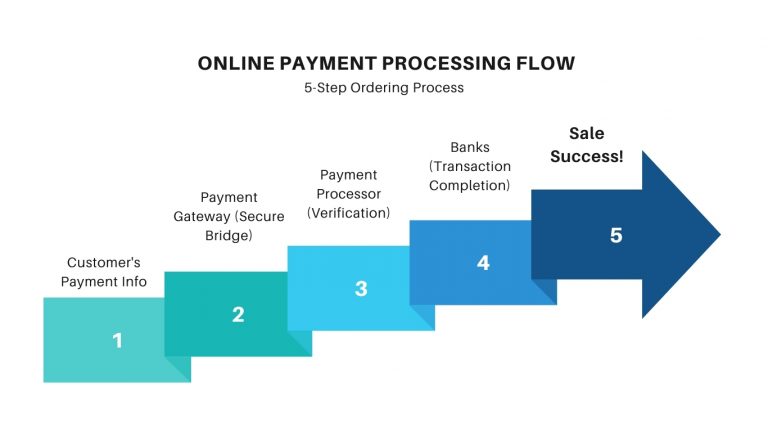

The Payment Symphony: How It All Works Together

Let’s get straight to the point and break down the payment process into three simple parts. It’s like a team, with each player having a special role. When they all work together, your customer’s payment goes through without a hitch. Knowing how these parts fit together helps you pick the best setup for your shop and keeps your customers happy.

This is Online Payment Processing Flow

- The Payment Gateway: A Secure Bridge

Imagine the payment gateway as a secure bridge. When customers enter their payment details on your store, this bridge ensures their information is encrypted and safely crosses over to the payment processor.

- The Payment Processor: Verifying Customer Solvency

The payment processor acts like a detective. It takes encrypted data and checks in with the customer’s bank to ensure everything is in order—there are enough funds, a valid account, etc. If all checks out, it gives a green light.

- The Issuing and Acquiring Banks: Completing the Transaction

Finally, the customer’s bank (issuing bank) and your store’s (acquiring bank) finish the job. The customer’s bank sends the money, and your bank welcomes it into your account. It’s the final step that wraps up the sale.

When these three elements sync up perfectly, you have a seamless payment experience that keeps your customers satisfied and your business thriving. It’s the kind of harmony that makes everyone involved tap their feet to the rhythm of a successful sale.

Don't Lose Sales at Checkout: How Payment Providers Boost Conversion Rates

- Now, why should an online shop have different ways to pay? It’s like having different flavours of ice cream – everyone has their favourite. Some people like to spend time with their credit cards, while others might want to use PayPal, Apple Pay, or even cryptocurrencies. When a store offers these options, it’s like saying, “Hey, we’ve got your favourite flavour! More options mean more happy 😄 (and paying) customers!

- The right payment provider does more than handle transactions. A clunky checkout process can be a dealbreaker. The best payment providers offer a smooth, streamlined experience. Think about one-click purchases, autofill for saved information, and mobile-friendly interfaces. These features make it a breeze for customers to pay, reducing the chances of them getting frustrated and abandoning their cart.

Real-World Checkout Success Story:

-

Let’s take a peek at a real example. “Groovy Gadgets,” an online electronics store, struggled with high cart abandonment rates. They partnered with a payment provider offering a more comprehensive range of options, including local digital wallets popular in their target market. Guess what? Within six months, Groovy Gadgets saw a 20% decrease in abandoned carts! Simply providing more payment flexibility unlocked a smoother checkout experience and happier customers.

The bottom line? Remember to underestimate the power of your payment provider. Choosing the right one can mean the difference between abandoned carts and satisfied customers hitting that “purchase” button.

Swipe Right (or Left): Choosing the Perfect Payment Method

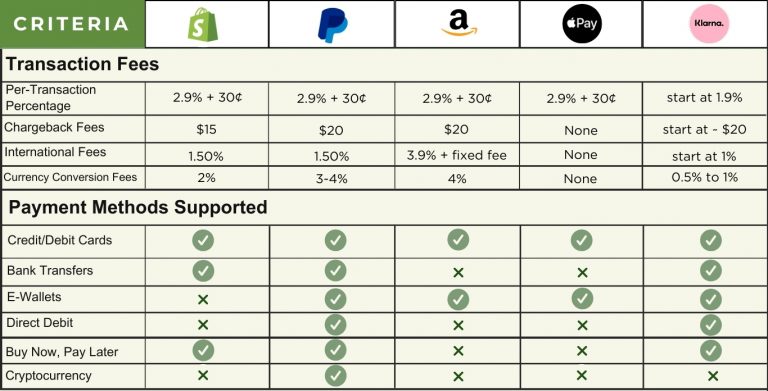

Balancing Cost & Choice: Transaction Fees vs. Supported Payment Options

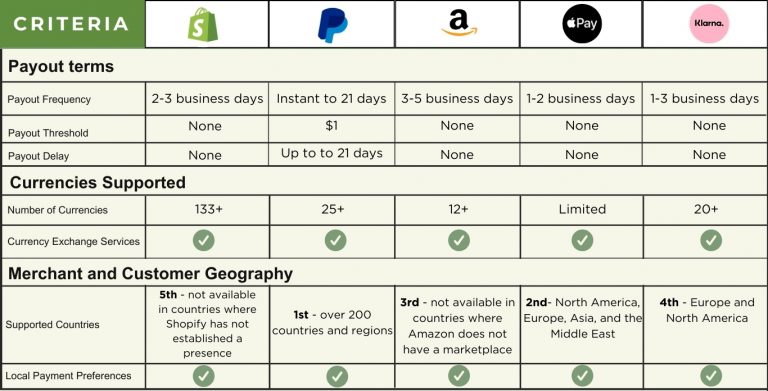

Beyond Borders: Payout Speed, Supported Currencies, & Geographic Restrictions

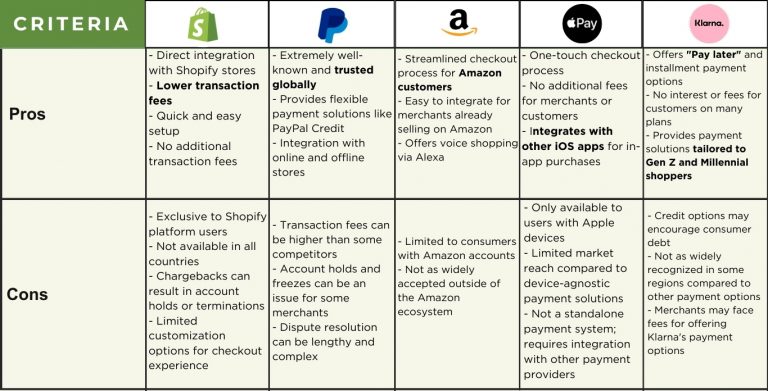

Understanding the Trade-Offs: Advantages & Disadvantages

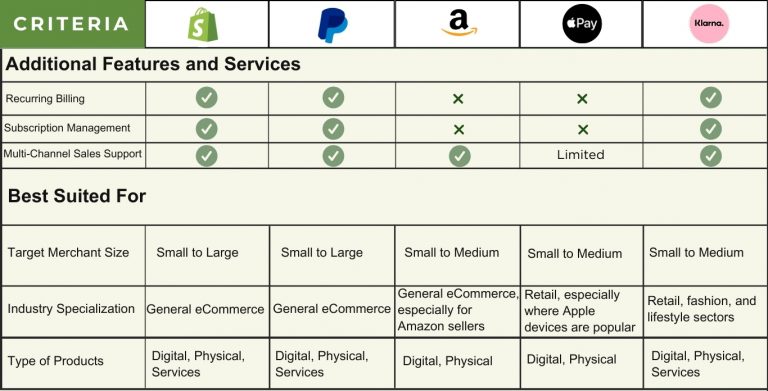

Who Needs This? Best Suited Businesses for Different Payment Gateways

Potential Risks: Mind the Money Flow

We’ve established that different payment providers offer unique advantages for your Shopify store. But every rose has its thorn, and when it comes to payment processing, there are potential financial risks. Here’s a breakdown of concerns associated with the five popular payment processors we discussed:

Shopify Payments:

- Additional fees for using external Payment Gateways: If you decide to use external payment gateways instead of Shopify, you will incur additional fees, typically a schedule of around 2.0% for basic Shopify plans, 1.0% for Shopify plans, and 0.5% for advanced Shopify. On top of this, you may face additional charges from your chosen payment gateway, such as PayPal or AmazonPay.

- Funds held up to 180 business days: Imagine waiting for nearly half a year to access your funds! For some, this is a stark reality. In extreme cases, Shopify can hold onto your payouts, preventing them from entering your bank account for an astonishing 180 business days. While this is to safeguard against financial anomalies, for business owners, especially those running small businesses, this can significantly hamper operations

- Shopify Payments can shut you down without warning or cause if you do business in a vertical area with an increased risk of fraud and frequent chargebacks (like check-cashing services, gambling and travel) because Shopify Payments may not support high-risk businesses. Yes, you will be able to open your store with their payment gateway, but it’s only a matter of time before it gets shut down and your funds held. And it’s unfortunate that Shopify isn’t clearer during the registration process about these business details that can make or break your store.

To make a long story short: If you need a high-risk merchant account on Shopify, you’ll need to look for a third-party payment processor. Shopify Payments are not good with chargebacks.

Dealing with Shopify’s payment rules can be tricky and costly. Plus, they can shut down your store’s payment system suddenly. This is exactly what happened to some beauty shops, as we see in a case study from Beauty Independent.

Bella Vérité, a beauty brand that launched with Shopify, was abruptly cut off from Shopify Payments Gateway just two months after its launch. The brand had to close for over a week, losing thousands of dollars in sales, as they scrambled to find a new payment processing provider.

The issue arose because Shopify and its partners categorized common beauty products as high-risk pseudo pharmaceuticals. This categorization led to Shopify cutting off payment services to beauty retail and brand e-commerce sites carrying such merchandise. The exact number of affected sites is uncertain, but it’s clear that businesses in the United States, Canada, and Australia, such as Indie Apothecary, Take Care, Apoterra Skincare have been impacted, resulting in substantial financial losses.

Shopify’s decision to disallow certain merchants from its payment service was often swift and final. The company gave merchants no time to 48 hours to change payment processing providers, often alerting them late in the week, making it challenging to move over to an alternative payment processor promptly.

This case study highlights the potential risks and challenges associated with using Shopify’s payment processing service, particularly for businesses in the beauty industry. It underscores the importance of understanding the terms of service and being prepared with alternative payment processing options.

Solution: Don’t put all your eggs in one basket! Offer alternative payment options to minimize dependence on a single provider and ensure a more stable flow of incoming funds.

Paypal

- Personal paypal account has many limitations: Many merchants use personal Paypal account for Dropshipping, and they have encountered many limitations: lower withdrawal and transaction limits, restricted access to certain features like invoicing and payment processing, and potentially higher fees for receiving payments.

- PayPal may place a hold on funds from 3 to 5 days, and in some cases, up to 21 days because of security reasons to protect customers from potential fraud by online stores. This can be inconvenient for sellers, affecting your operations. The hold is lifted once PayPal confirms the legitimacy of the transactions and that the products are shipped to customers. Funds are released when the buyer confirms receipt of the item in the expected condition. You can take steps to speed up this process.

Funds could be on hold for several reasons, including:

- New Sellers: Building buyer-seller trust and a history of successful transactions is essential for new sellers to change their hold status.

- Inactivity: If you haven’t sold anything for a while, you’ll need to re-establish your credibility.

- Refunds/Disputes/Chargebacks: Multiple flags from customers for various issues may lead PayPal to delay releasing your funds.

- Unusual Selling Patterns: Accounts with a sudden increase in sales or changes in the types of items sold may be flagged by PayPal.

- Selling Risky Items: Selling items like tickets, gift cards, electronics, computers, or travel packages can be considered risky, and PayPal will take time to review these transactions.

Solution:

- Switch to a business account for some features such as invoicing, payment processing, and merchant services, as well as lower fees and higher transaction and withdrawal limits.

- To prevent PayPal from freezing your funds and to access your money faster, consider using a reliable tool like Synctrack. This tool is recognized for its ability to help users sidestep typical PayPal issues. With Synctrack, you can have peace of mind knowing it assists in avoiding complications when receiving payments through PayPal, particularly during periods of significant order volume increases.

Amazon Pay

- Risk: While trusted by many, Amazon Pay limits your customer base to those with Amazon accounts. This can exclude many potential buyers, impacting your overall sales volume.

- Solution: Offer a more comprehensive range of payment options beyond Amazon Pay to reach a broader audience and maximize your sales potential.

Apple Pay

- Risk: Apple Pay caters specifically to Apple device users, potentially excluding a large segment of the online shopping population. This can restrict your customer base and limit your revenue stream.

- Solution: Provide alternative payment methods alongside Apple Pay to capture a more diverse customer base and ensure you get all the potential sales.

Klarna

- Risk: Klarna’s “Buy Now, Pay Later” option can entice customers but also lead to overspending and potential payment defaults. If customers fail to meet their payment obligations, you will lose revenue.

- Solution: Communicate loan terms, late fees, and consequences of non-payment to customers. Consider offering Klarna only for specific product categories and implementing a responsible credit check process to minimize the risk of defaults.

Remember, Security is Key

PCI Compliance is Mandatory: Ensure your chosen payment provider adheres to Payment Card Industry (PCI) Data Security Standards. This protects sensitive customer information and minimizes the risk of financial losses due to data breaches.

Be Proactive About Fraud: Utilize the fraud detection tools offered by your payment processor and consider additional security measures for your Shopify store. A multi-layered approach helps safeguard your financial well-being.

By understanding these potential financial risks, you can make an informed decision when choosing a payment provider. Remember, striking a balance between convenience, security, and a smooth flow of incoming funds is essential for the financial health of your online store.

Critical Considerations for Choosing Shopify's Best Payment Providers

All of the above has shed light on the strengths and weaknesses of five popular payment providers for your Shopify store. Here are some key takeaways to empower your decision:

Focus on Seamless Integration:

- Shopify Payments: This in-house solution boasts the tightest integration with your Shopify store, offering a frictionless checkout experience and potentially lower transaction fees for Shopify users. (For example, a clothing store owner enjoys a streamlined setup and faster checkout for customers, leading to a boost in sales.)

Prioritize Global Reach:

- PayPal: Renowned for its global presence (over 200 countries!), PayPal caters to a broad customer base and facilitates transactions in various currencies. (For example, an international jewellery seller can accept payments from customers worldwide, expanding their market reach significantly.)

Leverage Brand Recognition:

- Apple Pay: This innovative solution prioritizes advanced security features and offers a one-touch checkout experience for Apple device users. (For example, a tech accessories store can cater to a tech-savvy customer base by providing the secure and convenient Apple Pay option, potentially increasing sales among iPhone and iPad users.)Embrace Cutting-Edge Security:

- Apple Pay: This innovative solution prioritizes advanced security features, offering a one-touch checkout experience for Apple device users. (Example: A tech accessories store can cater to a tech-savvy customer base by providing the secure and convenient Apple Pay option, potentially increasing sales among iPhone and iPad users.)

Offer Flexible Payment Options:

- Klarna: This provider presents a unique advantage with its “Buy Now, Pay Later” options, potentially enticing customers with flexible payment plans and boosting conversions. (Example: A furniture store can offer customers the option to spread out payments, making high-ticket items more accessible and potentially leading to more sales.)

Choosing the Right Partner:

The ideal payment provider depends on your specific business needs. Here’s a simplified recommendation guide:

- For seamless integration and potentially lower fees, Shopify Payments (if you’re a Shopify user)

- For a global audience and established brand trust, PayPal.

- For leveraging the Amazon ecosystem and customer trust: Amazon Pay (if you’re an Amazon seller)

- For a tech-savvy clientele and top-notch security: Apple Pay (if your target audience uses Apple devices)

- For offering flexible payment options and potentially boosting conversions: Klarna (especially for high-ticket items)

Conclusion

You can make an informed decision by understanding the unique advantages each provider offers and the considerations specific to your business. Remember, there’s no “one size fits all” solution. But you can keep in mind about some essential factors below:

- Prioritize a frictionless checkout experience: Minimize steps and offer various payment options to cater to customer preferences.

- Balance convenience with security: Choose a payment provider that adheres to PCI compliance and offers strong fraud protection measures.

- Consider your target audience. Global reach, brand recognition, and flexible payment options may be relevant to your customer base.

- Mitigate risks: Implement clear return policies, monitor suspicious activity, and diversify your payment options to minimize dependence on a single provider.

Remember, a secure and efficient payment system is the cornerstone of a thriving online business. Make the right choice and watch your sales flourish!

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 2

No votes so far! Be the first to rate this post.